A new digital pawning system

The client

Founded in 1614, the Stadsbank van Lening (City Bank of Loans) is the oldest credit distributor in Amsterdam. Here, you can borrow money against collateral. The collateral and the loan sum are registered in the pawn system. It’s an important facility for Amsterdam’s underprivileged citizens – almost 10% of the city’s minimum-wage citizens uses it.

The challenge

The municipality of Amsterdam (owner of the Stadsbank van Lening) asked INFO to rebuild and optimise the pawn system that the Stadsbank van Lening had been using for over fifteen years. The main goal? To create more efficiency so that customers can be served faster. Additionally, from a social standpoint, it’s paramount that customers are able to repay their debts as fast as possible. To encourage this, the municipality also asked us to improve the existing online customer environment.

The solution

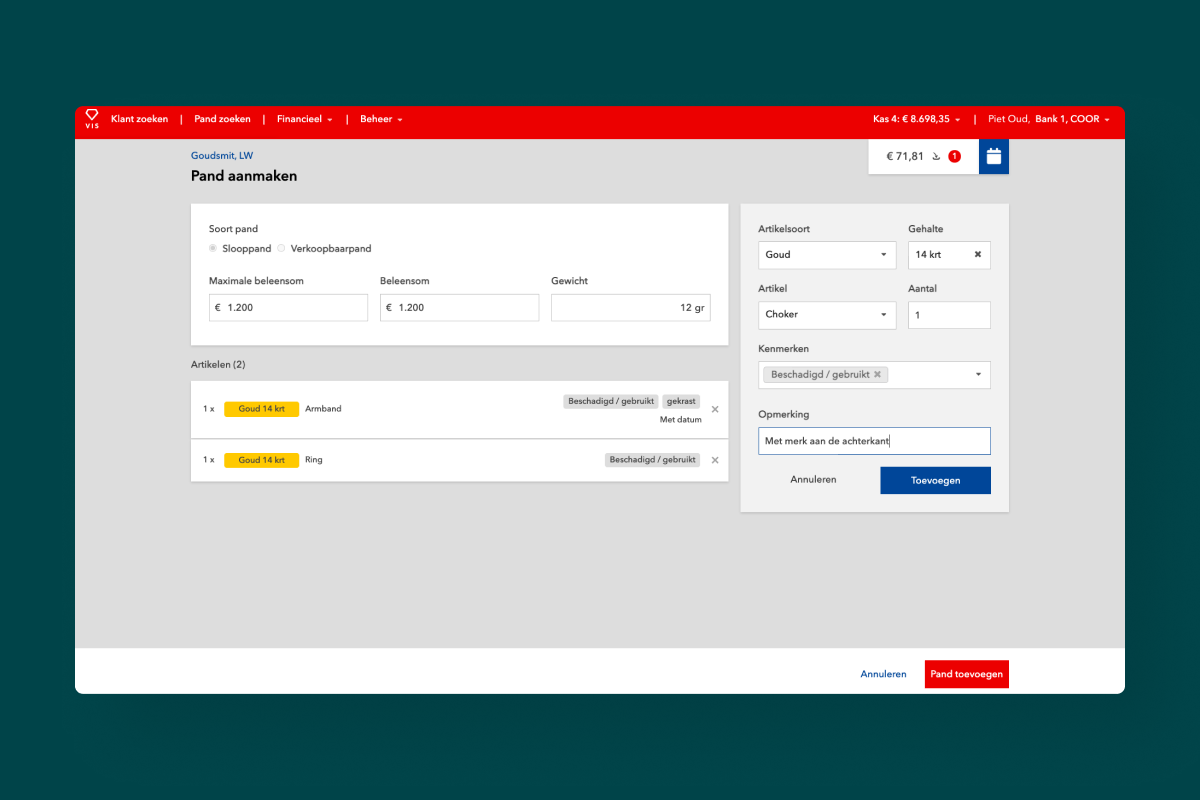

We analysed Stadsbank’s processes through employee shadowing and workshops, uncovering bottlenecks in the old system. We also used co-creating sessions with employees, to devise initial concepts for a new loan system that focused on employee efficiency for quicker customer service. We streamlined desk processes, merging workflows and granting employees instant access to crucial customer data. Close collaboration with Stadsbank experts ensured that the users got what they needed.

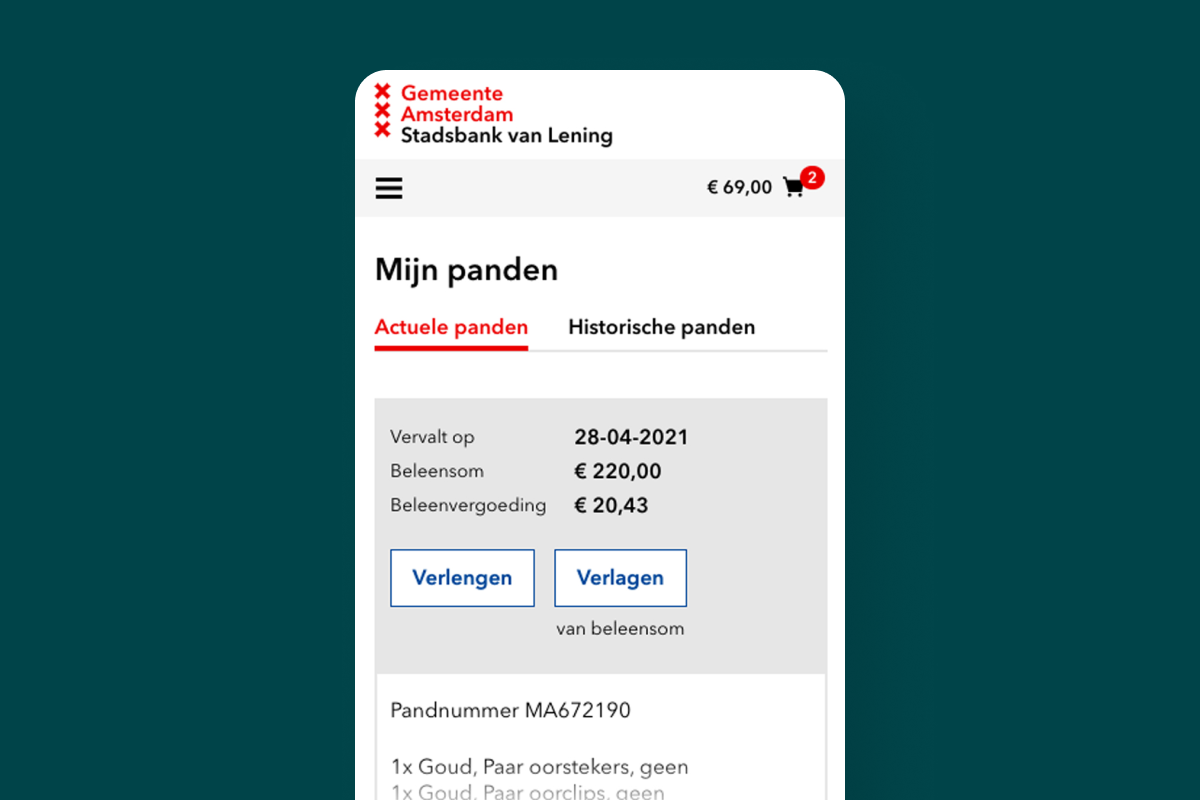

Additionally, we developed an online client portal, enabling customers to manage pawns and loans on their own, encouraging faster debt repayment.

The tech stack

- Kotlin

- React & Node.js

- GraphQL

- Keycloak

- Kubernetes & Docker

The results

Our combined efforts had great results: all 32 front desks across three locations switched over to the new system in a single day. This included 611,128 migrated pawns. The first months, 7,224 people used the new Mijn SBL to manage their loans. And because the new system flags issues faster, the Stadsbank van Lening is able to refer customers to debt assistance on time, preventing further problems down the road.

Stadsbank van Lening about our collaboration:

“A contemporary system. Simple and user-friendly. Clear menus and an attractive design. To me, the concise menus are surprisingly versatile. It may look a little thin at first, but the tasks have completely logical sub searches built in. It’s easy to become familiar with this system quickly.”

– Stadsbank van Lening

Let’s look ahead together

Get in touch and let’s see how we can help you advance.

Hoite Polkamp

Director of Business Development